Calculate my income tax

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The next 30575 is taxed.

Excel Formula Income Tax Bracket Calculation Exceljet

If you make 188120 a year living in the region of New York USA you will be taxed 49347.

. These tools will help you to calculate your Federal and State. For example if your company had a total taxable income of 1 million and a tax. Input the appropriate numbers in this formula.

Effective tax rate 561. Your household income location filing status and number of personal. That means that your net pay will be 40568 per year or 3381 per month.

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. How much Australian income tax you should be paying. Taxable income x Tax rate Income tax expense.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Every salaried individual needs to pay applicable tax. Starting in 2022 there is no state income tax on the first 5000 of taxable income in Mississippi.

For instance it is common for working. Once you start using a good income tax calculator online you will realise its numerous benefits. You will be able to.

That means that your net pay will be 43041 per year or 3587 per month. Our income tax calculator calculates your federal state and local taxes based on several key inputs. However a flat rate of 5 applies to taxable income over.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. 2 days agoIn general the administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal income. Your marginal tax rate.

Total income tax -12312. The first 9950 is taxed at 10 995. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Pay Your Income Tax Error-Free With An Online Income Tax Calculator. Marginal tax rate 633. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

See How Easy It Is. New York Income Tax Calculator 2021. This tells you your take-home.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Your bracket depends on your taxable income and filing status. There are seven federal tax brackets for the 2021 tax year. 10 12 22 24 32 35 and 37.

Ad Whatever Your Investing Goals. New York state tax 3925. An income tax calculator is an online tool that lets you calculate your income tax liability based on the income generated in a year.

Use The Tax Calculator To Estimate Your Tax Refund Or The Amount You May Owe The IRS. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Helps you work out.

Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. State Income Tax Calculators.

Your average tax rate is 1967 and your marginal tax. What your take home salary will be when tax and the Medicare levy are removed.

How To Calculate Income Tax On Salary With Example

How Is Taxable Income Calculated How To Calculate Tax Liability

How To Calculate Federal Income Tax

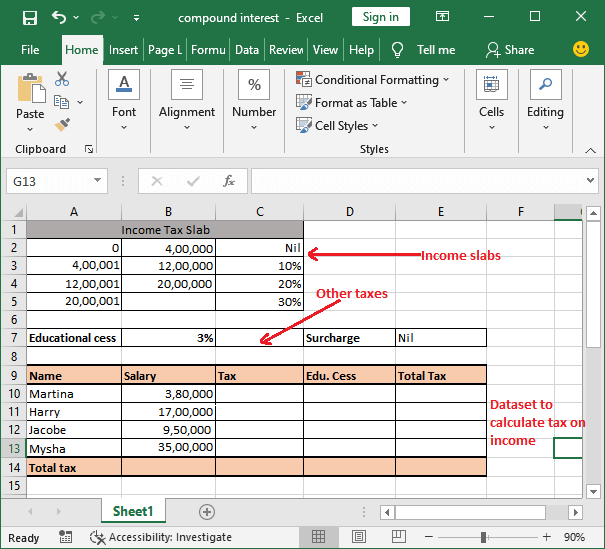

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

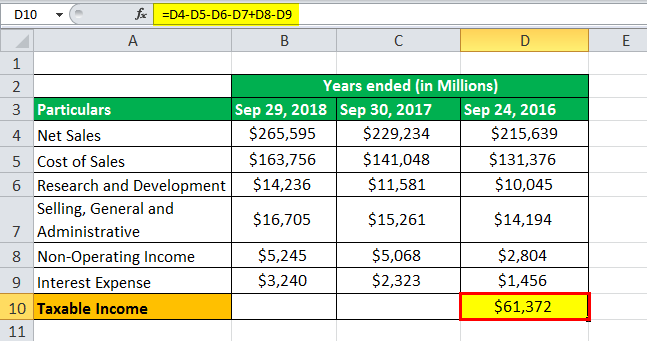

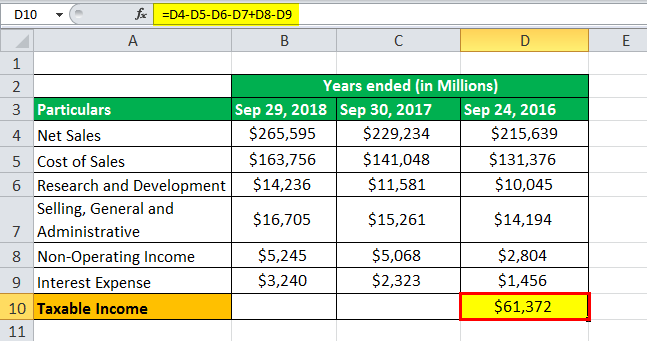

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Taxable Income Formula Examples How To Calculate Taxable Income